A team of geographic, environmental, geologic, and earth scientists (Stacy A. Carolina,1, Richard T. Walkera, Christopher C. Daya, Vasile Ersekb, R. Alastair Sloanc, Michael W. Deed, Morteza Talebiane, and Gideon M. Hendersona) sought to determine whether the decline of the first major civiliztion we know of, the Akkadian Empire, and an abrupt, transformative climate event were coincidental or correlated. According to their findings from analyzing archaeologic drought conditions and resulting increases in dust activity, the team’s work links the major climate event with the decline of the Akkadian empire as cause and effect.

The results of the teams research are established through marine samples from the northern read sea and the Gulf of Oman, and stalagmite core samples (GZ14-1) from

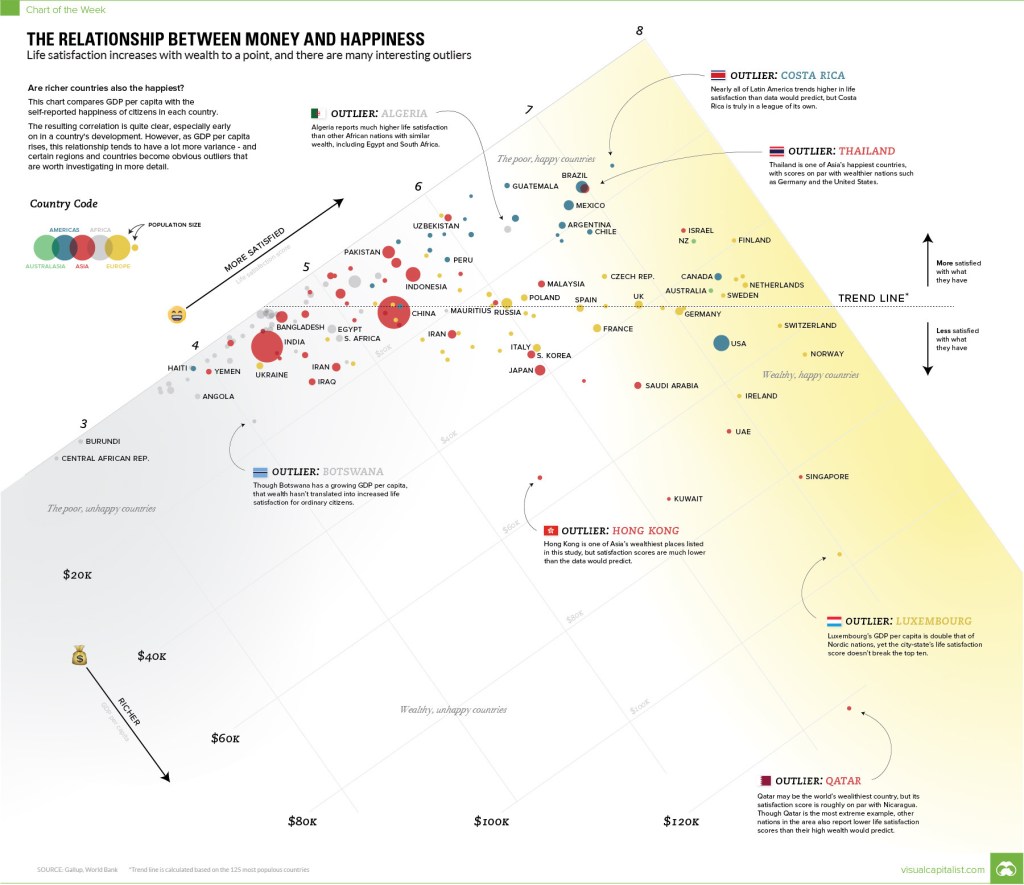

Gol-e-Zard Cave. These separate analyses were then synthesized into a comparative chart, posted below. The team compared their geographic and geologic “dust activity” results and regional climate patterns with existing archaeological findings regarding Mesopotamian settlements to show that the height of the Akkadian empire occurred when dust activity was lowest, and when drought conditions returned, the empire declines.

“ka” refers to how many thousand years before 1950 CE

Graphical representation of the evolution of rain-fed agricultural settlements in north Mesopotamia, which became urbanized around 4.5 ka, were imperialized by Akkad around 4.26 ka, and then were suddenly abandoned at 4.19 ± 0.018 (1σ) ka (17), coincident with the decline of the Akkadian empire

https://leilan.yale.edu/sites/default/files/publications/article-specific/carolin_et_al_2018_gol-e_zard_pnas-1.pdf

The inverse relationship established by the researchers is further enforced by written evidence from the Akkadians themselves. In the Curse of Agade (Akkad), striking passages highlight the effects climate had on the success of the empire, and also shows that the people were aware of the effects of changing climate on their lives, because climate change has a direct impact on the production of food. So much so, that the effects of changing climate are personified as gods in the literary source.

the large arable tracts yielded no grain, the inundated fields yielded no fish, the irrigated orchards yielded no syrup or wine, the thick clouds did not rain (149-175)… May [Naram-Sin’s impiety] make the city die of hunger! May your citizens, who used to eat fine food, lie hungry in the grass and herbs (245-255)

http://etcsl.orinst.ox.ac.uk/section2/tr215.htm

Despite the research of the team, there is still skepticism regarding the causal relationship between climate change and ancient empire collapse.

Karl W. Butzer wrote in Collapse, environment, and society, that

“collapse is multicausal and rarely abrupt… Undue attention to stressors risks underestimating the intricate interplay of environmental, political, and sociocultural resilience in limiting the damages of collapse or in facilitating reconstruction.” While then we should restrain applying the causal relationship between climate change and empire collapse to all Old World cases, we certainly see that the case of the collapse of the Akkadian empire is an example of environmental cause-and-effect.

There is often a popularized notion that history is a devalued subject, worth nothing to those of us in the present. We see, in our modern age, the technological luxuries which ease the suffering of life and see history as floods of barbarians with no notions of the subjects which provide us comfort. This is simply not the case. Akkad was an advanced empire, spanning across the central middle east, with compex organization, trade networks, irrigation systems, and organized writing and information distribution. Akkad is in fact similar to modern empires, and we should take the wise advice of history- climate change can collapse even the mightiest empire because, without regard to other effects, we all need to eat.